- Your cart is empty

- Continue Shopping

MMPF-002 Capital Investment and Financing Decisions Solved Assignment 2024-2025

₹40.00

MMPF-002 Capital Investment and Financing Decisions

Solved Assignment 2024-2025

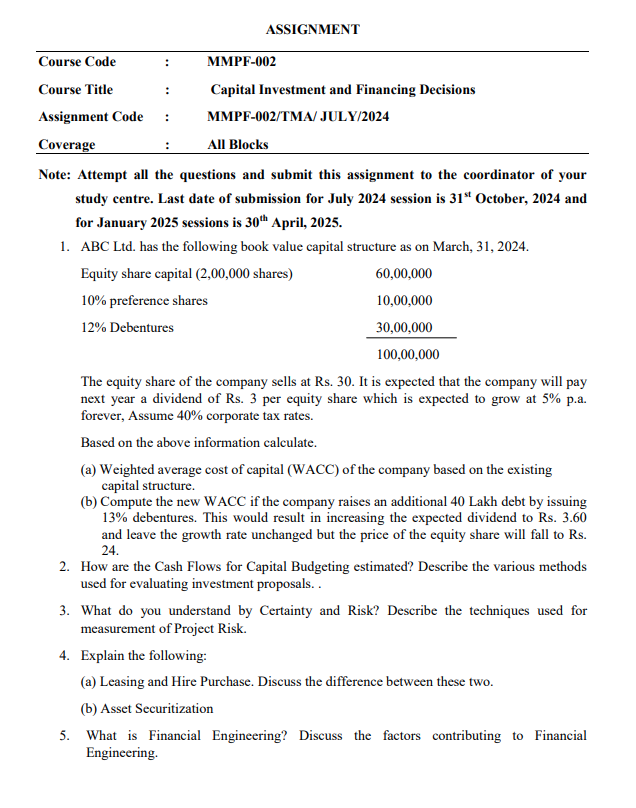

ASSIGNMENT

Course Code : MMPF-002

Course Title : Capital Investment and Financing Decisions

Assignment Code : MMPF-002/TMA/ JULY/2024

Coverage : All Blocks

MMPF-002 Capital Investment and Financing Decisions Solved Assignment 2024-2025

ASSIGNMENT

Course Code : MMPF-002

Course Title : Capital Investment and Financing Decisions

Assignment Code : MMPF-002/TMA/ JULY/2024

Coverage : All Blocks

| Title Name | MMPF-002 Solved Assignment 2024-2025 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | MBA and MBA (Banking & Finance) |

| Language | ENGLISH |

| Semester | 2024-2025 Course: MBA |

| Session | July 2024 and January 2025 Sessions |

| Short Name | MMPF-002 |

| Assignment Code | MMPF-002/TMA/ JULY/2024 |

| Product | Assignment of MBA and MBA (Banking & Finance) 2024-2025 (IGNOU) |

| Submission Date | Last date of submission for July session is 31st October and for January session is 30th April |

1. ABC Ltd. has the following book value capital structure as on March, 31, 2024.

Equity share capital (2,00,000 shares) 60,00,000

10% preference shares 10,00,000

12% Debentures 30,00,000

100,00,000

The equity share of the company sells at Rs. 30. It is expected that the company will pay

next year a dividend of Rs. 3 per equity share which is expected to grow at 5% p.a.

forever, Assume 40% corporate tax rates.

Based on the above information calculate.

(a) Weighted average cost of capital (WACC) of the company based on the existing

capital structure.

(b) Compute the new WACC if the company raises an additional 40 Lakh debt by issuing

13% debentures. This would result in increasing the expected dividend to Rs. 3.60

and leave the growth rate unchanged but the price of the equity share will fall to Rs.

24.

2. How are the Cash Flows for Capital Budgeting estimated? Describe the various methods

used for evaluating investment proposals. .

3. What do you understand by Certainty and Risk? Describe the techniques used for

measurement of Project Risk.

4. Explain the following:

(a) Leasing and Hire Purchase. Discuss the difference between these two.

(b) Asset Securitization

5. What is Financial Engineering? Discuss the factors contributing to Financial

Engineering.

MMPF-002, MMPF 002, MMPF002, MMPF-02, MMPF02, MMPF 02, MMPF-2, MMPF2, MMPF 2

Reviews

There are no reviews yet.