- Your cart is empty

- Continue Shopping

MEC-101/001 MICROECONOMIC ANALYSIS in English Solved Assignment 2022-2023

Tutor Marked Assignment (TMA)

Course Code: MEC-001/101

Assignment Code: Asst /TMA /2022-23

Total Marks: 100

| Title Name | MEC-101/001 Solved Assignment 2022-2023 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | MA(ECONOMICS) MEC |

| Language | ENGLISH |

| Semester | 2022-2023 Course: MA(ECONOMICS) MEC |

| Session | For July 2022 and January 2023 Sessions |

| Short Name | MEC-101/001 |

| Assignment Code | Asst /TMA /2022-23 |

| Product | Assignment of MA(ECONOMICS) 2022-2023 (IGNOU) |

| Submission Date | For July session, you need to submit the assignments by March 31, and for January session by September 30 for being eligible to appear in the term end examination.Assignments should be submitted to the Coordinator of your Study Centre. Obtain a receipt from the Study Centre towards submission. |

| Price | RS. 60 |

Note: Answer all the questions.

SECTION A

Answer the following questions in about 700 words each. The word limits do not apply in

case of numerical questions. Each question carries 20 marks.

2 × 20 = 40

1. a) Consider a pure-exchange economy of two individuals (A and B) and two goods (X

and Y) Individual A is endowed with 5 units of good X and 3 units of good Y, while

individual B with 3 and 4 units of goods X and Y respectively. Assuming utility functions

of individuals A and B to be UA=XA YA

2 and UB=XB

2 YB where Xi and Yi for i= {A, B}

represent individual i’s consumption of good X and Y respectively, what will be the set of

Pareto optimal allocation in this economy?

b) Determine the conditions that need to be fulfilled by an allocation to be termed as

Pareto efficient allocation.

2. Consider a Cobb-Douglas utility function

U (X, Y) = Xα Y (1- α)

,

Where X and y are the two goods that a consumer consumes at per unit prices of Px and

Py respectively. Assuming the income of the consumer to be ₹M, determine:

a. Marshallian demand function for goods X and Y.

b. Indirect utility function for such a consumer.

c. The maximum utility attained by the consumer where α =1/2, Px =₹ 2, Py = ₹ 8 and

M= ₹ 4000.

d. Derive Roy’s identity.

SECTION B

Answer the following questions in about 400 words each. Each question carries 12 marks.

5 X 12=60

3. a.) What is excess capacity and how is it related to the model of monopolistic

competition?

b) Demand function and supply function are given as P=25-X2 and P=2X+1 respectively,

find out producer surplus and consumer surplus.

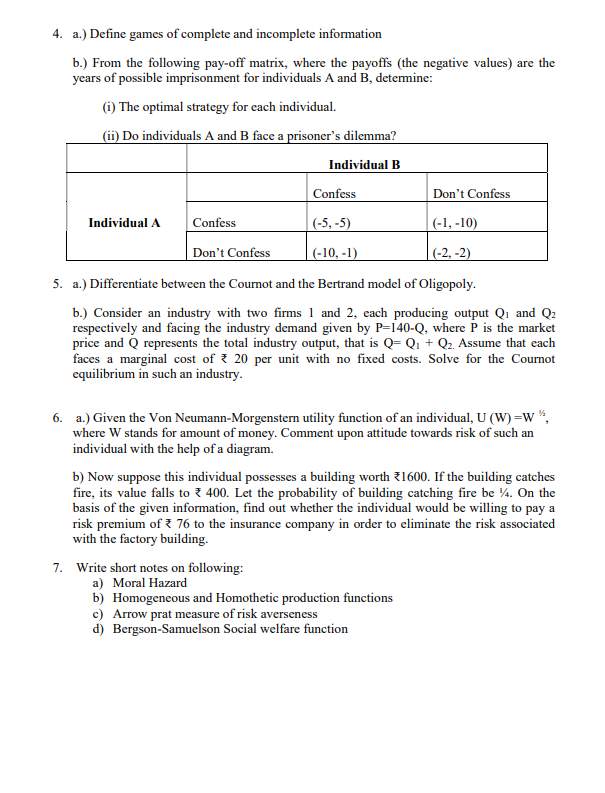

4. a.) Define games of complete and incomplete information

b.) From the following pay-off matrix, where the payoffs (the negative values) are the

years of possible imprisonment for individuals A and B, determine:

(i) The optimal strategy for each individual.

(ii) Do individuals A and B face a prisoner’s dilemma?

Individual B

Individual A

Confess Don’t Confess

Confess (-5, -5) (-1, -10)

Don’t Confess (-10, -1) (-2, -2)

5. a.) Differentiate between the Cournot and the Bertrand model of Oligopoly.

b.) Consider an industry with two firms 1 and 2, each producing output Q1 and Q2

respectively and facing the industry demand given by P=140-Q, where P is the market

price and Q represents the total industry output, that is Q= Q1 + Q2. Assume that each

faces a marginal cost of ₹ 20 per unit with no fixed costs. Solve for the Cournot

equilibrium in such an industry.

6. a.) Given the Von Neumann-Morgenstern utility function of an individual, U (W) =W ½

,

where W stands for amount of money. Comment upon attitude towards risk of such an

individual with the help of a diagram.

b) Now suppose this individual possesses a building worth ₹1600. If the building catches

fire, its value falls to ₹ 400. Let the probability of building catching fire be ¼. On the

basis of the given information, find out whether the individual would be willing to pay a

risk premium of ₹ 76 to the insurance company in order to eliminate the risk associated

with the factory building.

7. Write short notes on following:

a) Moral Hazard

b) Homogeneous and Homothetic production functions

c) Arrow prat measure of risk averseness

d) Bergson-Samuelson Social welfare function

MEC-001, MEC-01, MEC 001, MEC 01, MEC001, MEC01, MEC-1, MEC1, MEC

Reviews

There are no reviews yet.