- Your cart is empty

- Continue Shopping

BCOE-143 FUNDAMENTALS OF FINANCIAL MANAGEMENT in English Solved Assignment 2023-2024

Original price was: ₹100.00.₹40.00Current price is: ₹40.00.

BCOE-143 FUNDAMENTALS OF FINANCIAL MANAGEMENT

in English Solved Assignment 2023-2024

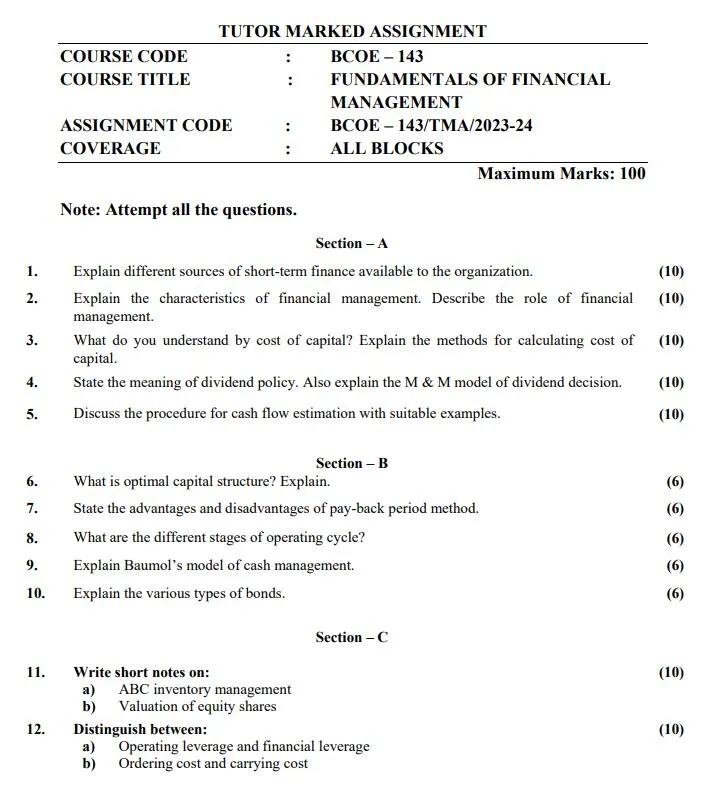

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOE – 143

COURSE TITLE : FUNDAMENTALS OF FINANCIAL

MANAGEMENT

ASSIGNMENT CODE : BCOE – 143/TMA/2023-24

COVERAGE : ALL BLOCKS

Maximum Marks: 100

BCOE-143 FUNDAMENTALS OF FINANCIAL MANAGEMENT in English Solved Assignment 2023-2024

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOE – 143

COURSE TITLE : FUNDAMENTALS OF FINANCIAL

MANAGEMENT

ASSIGNMENT CODE : BCOE – 143/TMA/2023-24

COVERAGE : ALL BLOCKS

Maximum Marks: 100

| Title Name | BCOE-143 Solved Assignment 2023-2024 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | ENGLISH |

| Semester | 2023-2024 Course: B.Com(G) CBCS |

| Session | Valid from 1st July, 2023 to 30th June, 2024 |

| Short Name | BCOE-143 |

| Assignment Code | BCOE – 143/TMA/2023-24 |

| Product | Assignment of BCOMG 2023-2024 (IGNOU) |

| Submission Date | Those students who are appearing in December Term End Examination they have to submit latest by in 15 October. Those students who are appearing in June exams. They should download the new assignment and submit the same latest by 15 March |

| Price | RS. 50 |

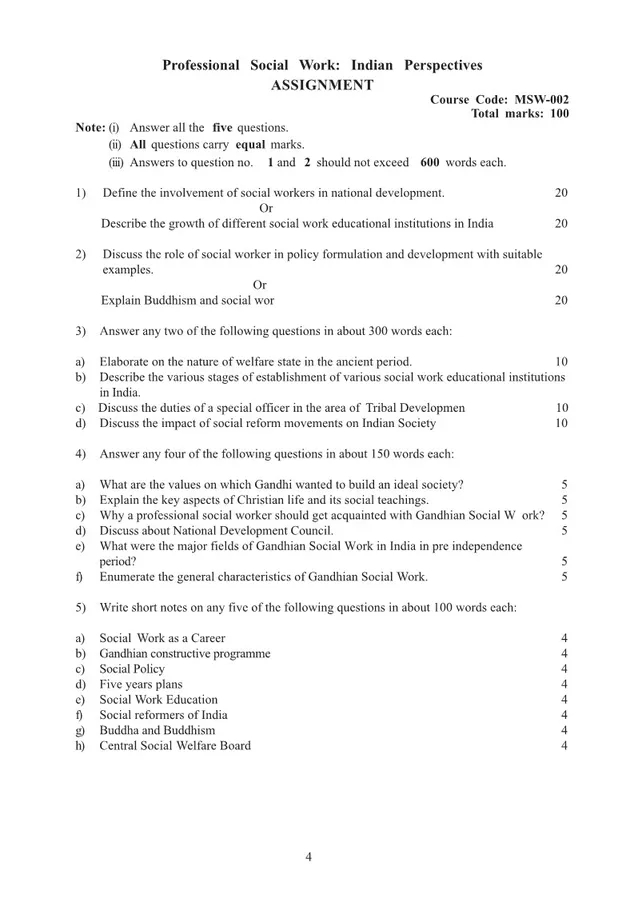

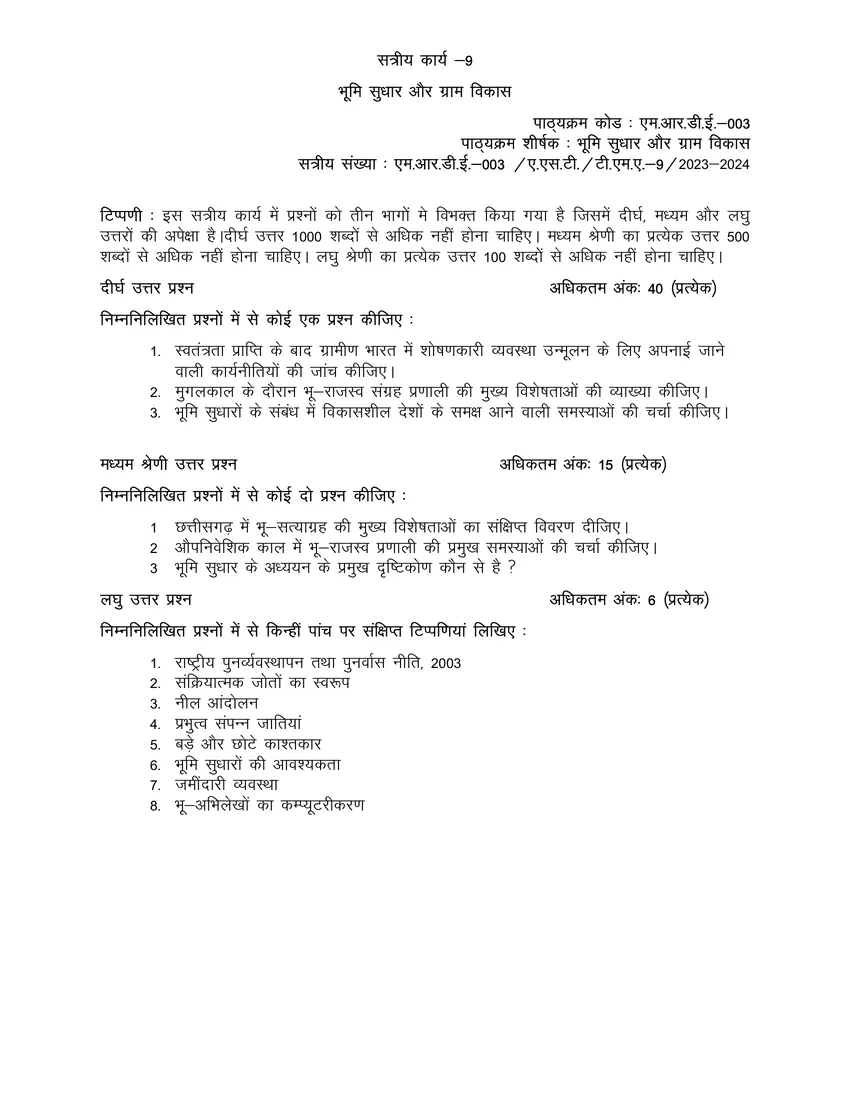

Note: Attempt all the questions.

Section – A

1. Explain different sources of short-term finance available to the organization. (10)

2. Explain the characteristics of financial management. Describe the role of financial

management.

(10)

3. What do you understand by cost of capital? Explain the methods for calculating cost of

capital.

(10)

4. State the meaning of dividend policy. Also explain the M & M model of dividend decision. (10)

5. Discuss the procedure for cash flow estimation with suitable examples. (10)

Section – B

6. What is optimal capital structure? Explain. (6)

7. State the advantages and disadvantages of pay-back period method. (6)

8. What are the different stages of operating cycle? (6)

9. Explain Baumol’s model of cash management. (6)

10. Explain the various types of bonds. (6)

Section – C

11. Write short notes on:

a) ABC inventory management

b) Valuation of equity shares

(10)

12. Distinguish between:

a) Operating leverage and financial leverage

b) Ordering cost and carrying cost

BCOE-143, BCOE 143, BCOE143

Reviews

There are no reviews yet.