- Your cart is empty

- Continue Shopping

BCOC-136 Income Tax Law and Practice in English Solved Assignment 2023-2024

₹40.00

BCOC-136 Income Tax Law and Practice

in English Solved Assignment 2023-2024

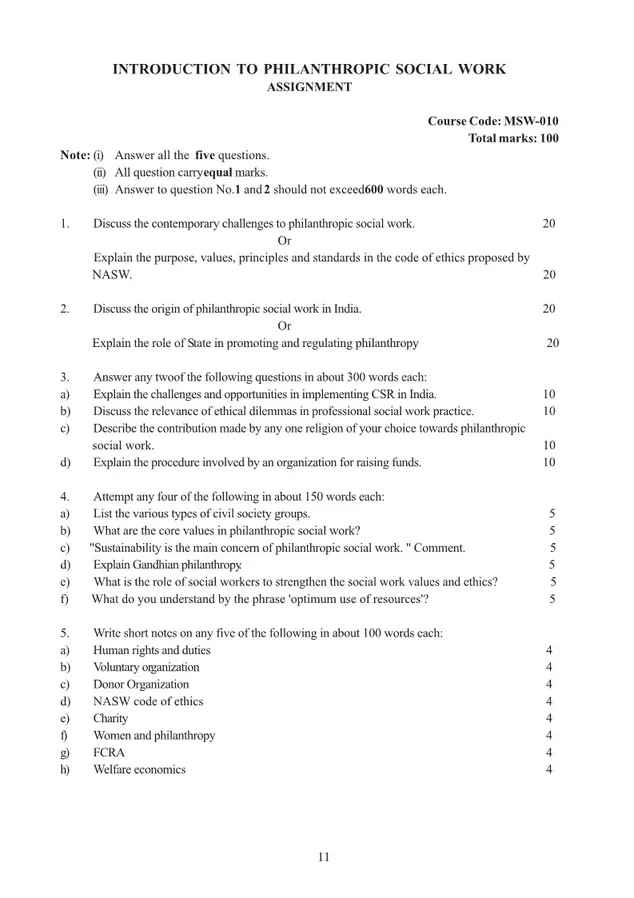

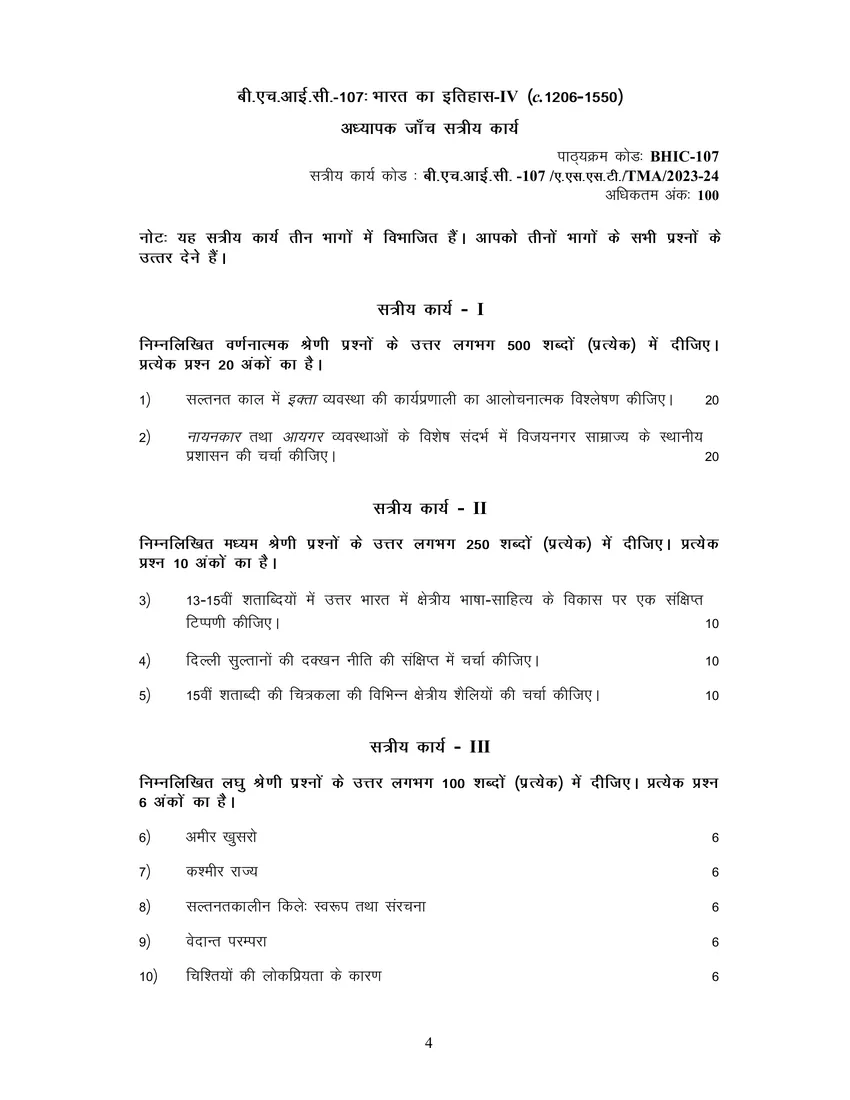

TUTOR MARKED ASSIGNMENT

Course Code : BCOC – 136

Course Title : Income Tax Law and Practice

Assignment Code : BCOC – 136 /TMA/2023-24

Coverage : All Blocks

Maximum Marks: 100

BCOC-136 Income Tax Law and Practice in English Solved Assignment 2023-2024

TUTOR MARKED ASSIGNMENT

Course Code : BCOC – 136

Course Title : Income Tax Law and Practice

Assignment Code : BCOC – 136 /TMA/2023-24

Coverage : All Blocks

Maximum Marks: 100

| Title Name | BCOC-136 Solved Assignment 2023-2024 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | ENGLISH |

| Semester | 2023-2024 Course: B.Com(G) CBCS |

| Session | Valid from 1st July, 2023 to 30th June, 2024 |

| Short Name | BCOC-136 |

| Assignment Code | BCOC – 136 /TMA/2023-24 |

| Product | Assignment of BCOMG 2023-2024 (IGNOU) |

| Submission Date | Those students who are appearing in December Term End Examination they have to submit latest by in 15 October. Those students who are appearing in June exams. They should download the new assignment and submit the same latest by 15 March |

| Price | RS. 50 |

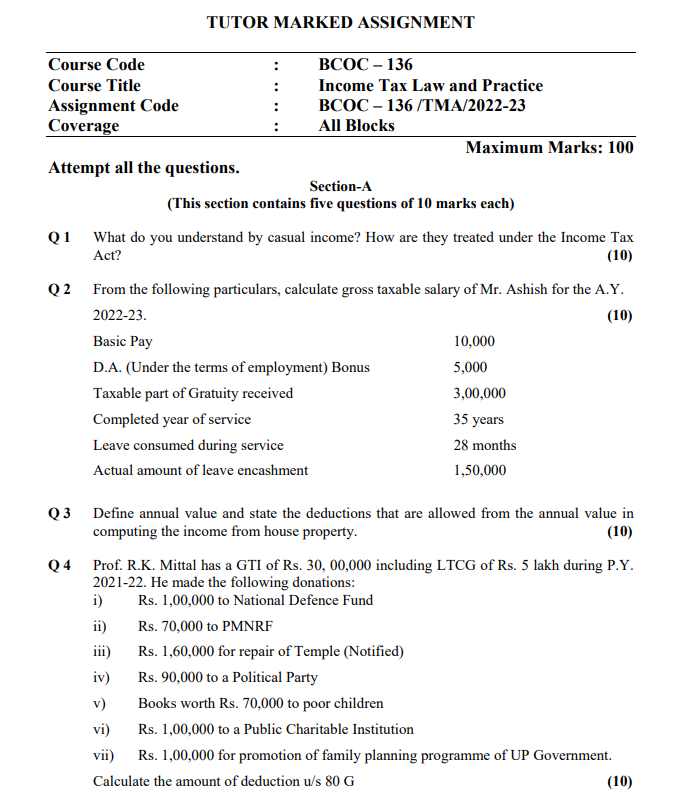

Attempt all the questions.

Section-A

1. What do you understand by casual income? Discuss the provision of casual

income under Income Tax Act?

(10)

2. Mr. Vikash is getting a pension Rs. 4,000 per month from a company.

During the previous year, he got two-third pension commuted and received

Rs. 1,86,000. Compute the exempted amount, if (a) he also received

gratuity (b) he did not received gratuity, for the assessment year 2022-23.

(10)

3. For the previous year 2021-22, the business income of X Ltd. before

allowing expenditure on family planning is Rs.3,00,000. The company had

incurred the following expenditure on family planning amongst its

employees during the previous year 2021-22:

(i) Revenue expenses on family planning Rs 1, 65,000.

(ii) Capital expenditure on family planning Rs 9, 00,000.

a) Compute the deduction available for expenditure on family planning to the

company assuming the company has income from other sources amounting

to Rs. 30,000.

b) What will be your answer if the revenue expenditure on family planning is

Rs. 2, 30,000 instead of Rs.1, 65,000?

(10)

4. The following particulars of income are submitted by Smt. Suman Garg for

the assessment year 2022-23. She lives at Delhi. i) Basic pay 10,000 p.m. ii)

Dearness allowance @ 10% of salary iii) HRA 30% of basic salary. iv)

Medical allowance Rs 200 p.m. (amount actually spent on her own

treatment is Rs. 2,000). v) Warden ship allowance 400 p.m. vi) Rent from

house Property Rs. 3,000 p.m. vii) Contribution to RPF 10% of basic salary.

viii) House rent paid Rs. 6,000 p.m. ix) Donation to approved charitable

institution Rs. 20,000 Compute her total income for assessment year 2022-

23.

(10)

5. Discuss the various kinds of Securities? Explain the rule regarding grossing

up of interest on Commercial Securities.

(10)

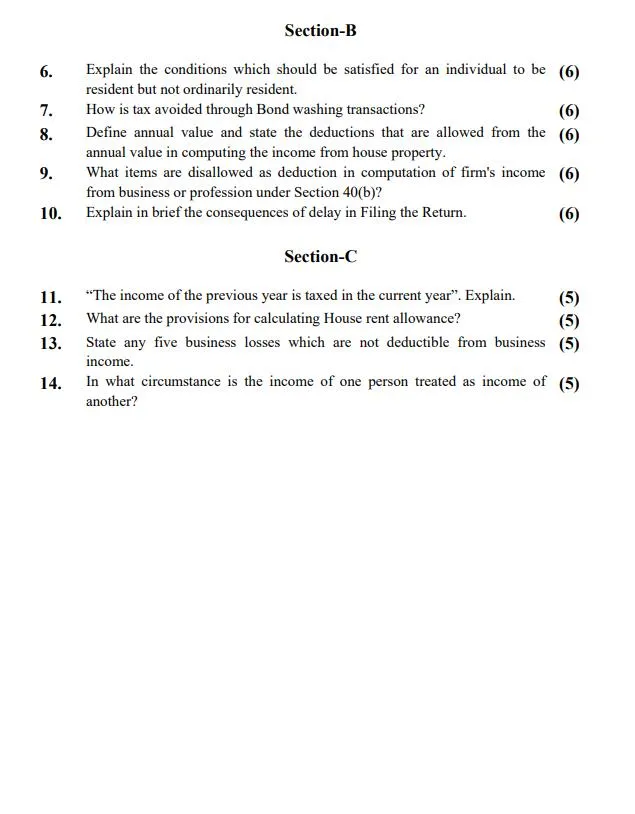

Section-B

6. Explain the conditions which should be satisfied for an individual to be

resident but not ordinarily resident.

(6)

7. How is tax avoided through Bond washing transactions? (6)

8. Define annual value and state the deductions that are allowed from the

annual value in computing the income from house property.

(6)

9. What items are disallowed as deduction in computation of firm’s income

from business or profession under Section 40(b)?

(6)

10. Explain in brief the consequences of delay in Filing the Return. (6)

Section-C

11. “The income of the previous year is taxed in the current year”. Explain. (5)

12. What are the provisions for calculating House rent allowance? (5)

13. State any five business losses which are not deductible from business

income.

(5)

14. In what circumstance is the income of one person treated as income of

another?

BCOC-136, BCOC 136, BCOC136

Reviews

There are no reviews yet.