- Your cart is empty

- Continue Shopping

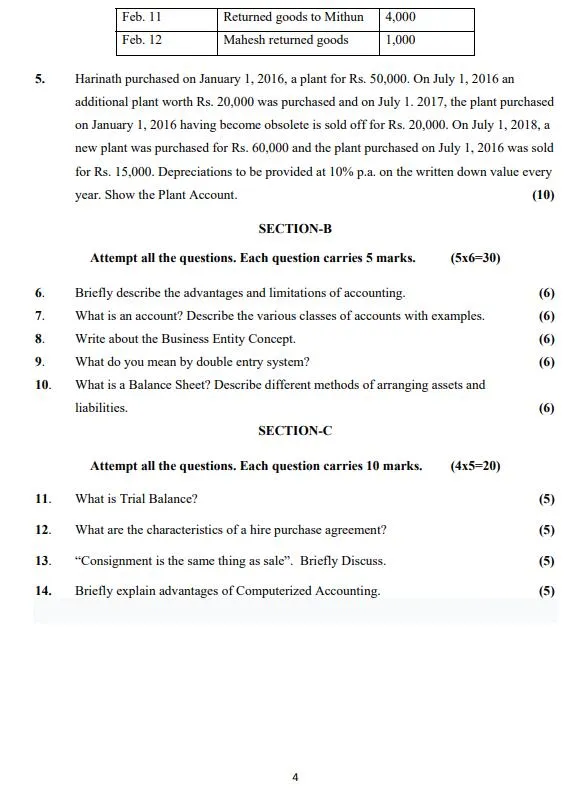

BCOC-131 (B. Com G) Financial Accounting in English Solved Assignment 2023-2024

Original price was: ₹100.00.₹40.00Current price is: ₹40.00.

Bcom G BCOC-131 Financial Accounting

in English Solved Assignment 2023-2024

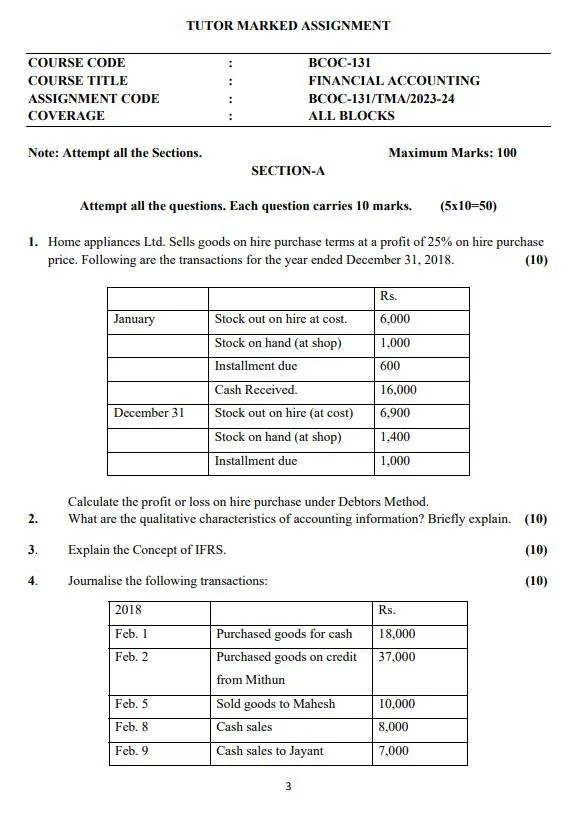

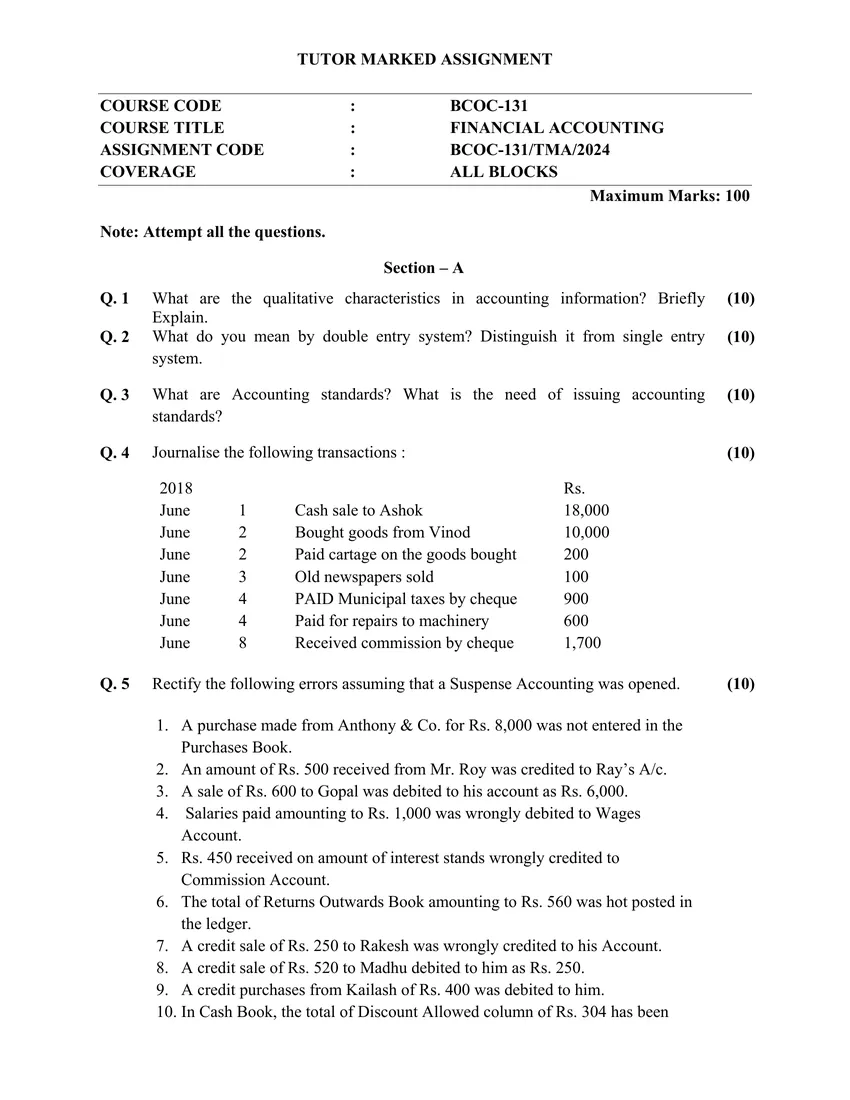

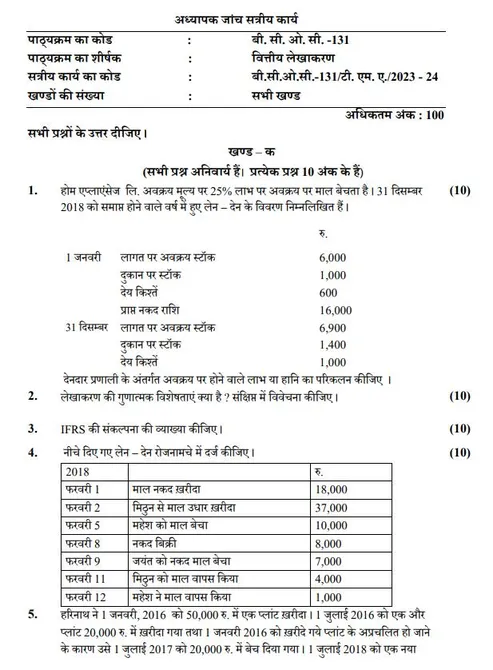

COURSE CODE : BCOC-131

COURSE TITLE : FINANCIAL ACCOUNTING

ASSIGNMENT CODE : BCOC-131/TMA/2023-24

COVERAGE : ALL BLOCKS

Add to cart

Buy Now

BCOC-131 (B. Com G) Financial Accounting in English Solved Assignment 2023-2024

COURSE CODE : BCOC-131

COURSE TITLE : FINANCIAL ACCOUNTING

ASSIGNMENT CODE : BCOC-131/TMA/2023-24

COVERAGE : ALL BLOCKS

| Title Name | BCOC-131 Solved Assignment 2023-2024 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | ENGLISH |

| Semester | 2023-2024 Course: B.Com(G) CBCS |

| Session | Valid from 1st July, 2023 to 30th June, 2024 |

| Short Name | BCOC-131 |

| Assignment Code | BCOC-131/TMA/2023-24 |

| Product | Assignment of BCOMG 2023-2024 (IGNOU) |

| Submission Date | Those students who are appearing in December Term End Examination they have to submit latest by in 15 October. Those students who are appearing in June exams. They should download the new assignment and submit the same latest by 15 March |

| Price | RS. 50 |

BCOC-131, BCOC131, BCOC 131,

Reviews

There are no reviews yet.