- Your cart is empty

- Continue Shopping

BCOE-143 FUNDAMENTALS OF FINANCIAL MANAGEMENT in English Solved Assignment 2024-2025

₹40.00Current price is: ₹40.00. Original price was: ₹100.00.

BCOE-143 FUNDAMENTALS OF FINANCIAL MANAGEMENT

Solved Assignment 2024-2025

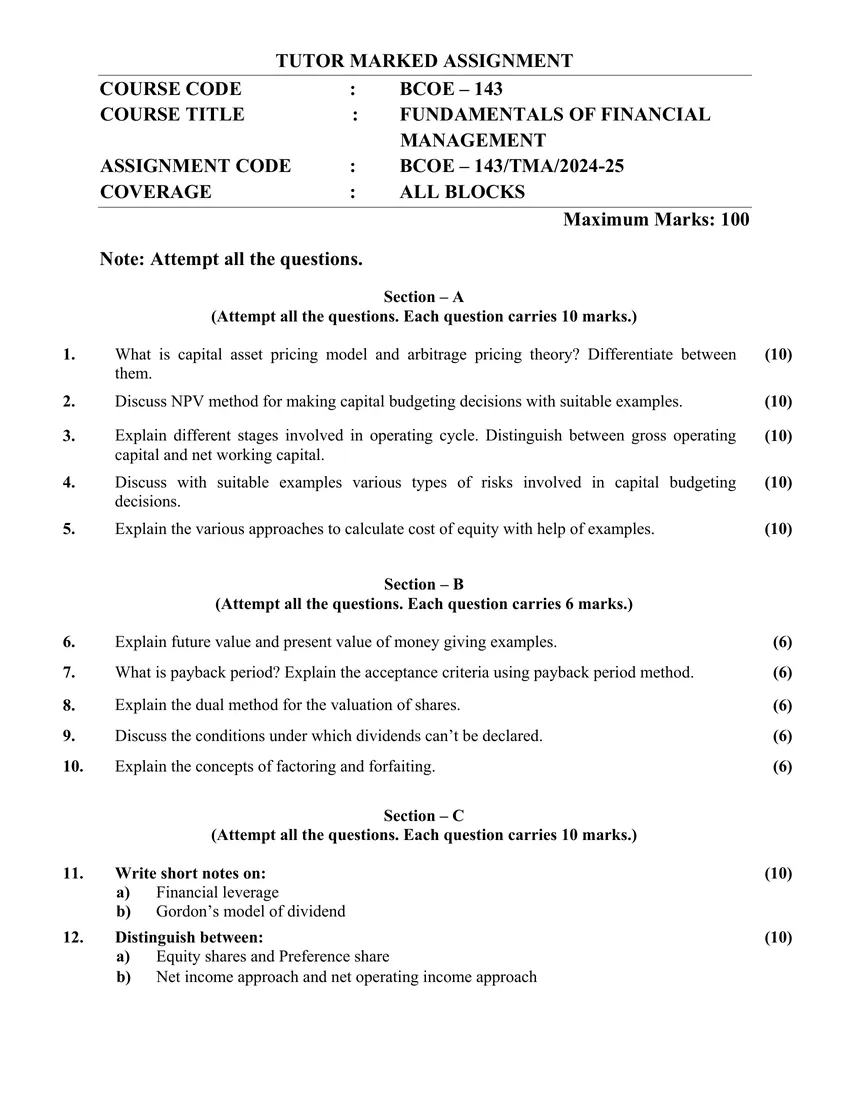

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOE – 143

COURSE TITLE : FUNDAMENTALS OF FINANCIAL

MANAGEMENT

ASSIGNMENT CODE : BCOE – 143/TMA/2024-25

COVERAGE : ALL BLOCKS

Maximum Marks: 100

BCOE-143 FUNDAMENTALS OF FINANCIAL MANAGEMENT Solved Assignment 2024-2025

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOE – 143

COURSE TITLE : FUNDAMENTALS OF FINANCIAL

MANAGEMENT

ASSIGNMENT CODE : BCOE – 143/TMA/2024-25

COVERAGE : ALL BLOCKS

Maximum Marks: 100

| Title Name | BCOE-143 Solved Assignment 2024-2025 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | ENGLISH |

| Semester | 2024-2025 Course: B.Com(G) CBCS |

| Session | Valid from 1st July, 2024 to 30th June, 2025 |

| Short Name | BCOE-143 |

| Assignment Code | BCOE – 143/TMA/2024-25 |

| Product | Assignment of BCOMG 2024-2025 (IGNOU) |

| Submission Date | December Term End Examination: 15 October June Term End Examination: 15 March |

Note: Attempt all the questions.

Section – A

(Attempt all the questions. Each question carries 10 marks.)

1. What is capital asset pricing model and arbitrage pricing theory? Differentiate between

them.

(10)

2. Discuss NPV method for making capital budgeting decisions with suitable examples. (10)

3. Explain different stages involved in operating cycle. Distinguish between gross operating

capital and net working capital.

(10)

4. Discuss with suitable examples various types of risks involved in capital budgeting

decisions.

(10)

5. Explain the various approaches to calculate cost of equity with help of examples. (10)

Section – B

(Attempt all the questions. Each question carries 6 marks.)

6. Explain future value and present value of money giving examples. (6)

7. What is payback period? Explain the acceptance criteria using payback period method. (6)

8. Explain the dual method for the valuation of shares. (6)

9. Discuss the conditions under which dividends can’t be declared. (6)

10. Explain the concepts of factoring and forfaiting. (6)

Section – C

(Attempt all the questions. Each question carries 10 marks.)

11. Write short notes on:

a) Financial leverage

b) Gordon’s model of dividend

(10)

12. Distinguish between:

a) Equity shares and Preference share

b) Net income approach and net operating income approach

BCOE-143, BCOE 143, BCOE143

Reviews

There are no reviews yet.