- Your cart is empty

- Continue Shopping

BCOE-142 MANAGEMENT ACCOUNTING Solved Assignment 2025

COURSE CODE : BCOE-142

COURSE TITLE : MANAGEMENT ACCOUNTING

ASSIGNMENT CODE : BCOE-142/TMA/2025

COVERAGE : ALL BLOCKS

| Title Name | BCOE-142 Solved Assignment 2025 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | ENGLISH |

| Semester | 2025 Course: B.Com(G) CBCS |

| Session | Valid from 1st January 2025 to 31st December 2025 |

| Short Name | BCOE-142 |

| Assignment Code | BCOE-142/TMA/2025 |

| Product | Assignment of BCOMG 2025 (IGNOU) |

| Submission Date | June Term End Examination: 15th March December Term End Examination: 15th October |

Note: Attempt all the questions.

Section – A

1) Define Management Accounting and briefly describe its objectives. (10)

2) What are the essentials of establishment of sound system of Budgeting? (10)

3) A company has decided to introduce a system of standard costing. What are the

preliminaries to be considered before developing such a system? Explain. (10)

4) Calculate Direct Material Cost Variance with the help of the following information:

Standard output : 1600 units

Actual output : 2000 units

Standard quantity required per unit : 2 kg

Total quantity actually consumed : 2400 kg

Standard rate per unit : Rs 8 per kg

Actual rate per unit : Rs 10 per kg (10)

5) “The profit is the product of the P/V ratio and the margin of safety.” Comment. (10)

Section – B

6) XYZ Ltd. is manufacturing selling four types of products A, B, C and D. The sales mix

and variable costs are as follows:

Product Sales per month Variable Cost Ratio

A 2,00,000 50%

B 1,50,000 50%

C 1,00,000 75%

D 2,50,000 40%

The fixed costs are 1,50,000 per month. Calculate break even point.

(6)

7) What do you understand by differential costing? How does it differ from managerial costing? (6)

8) What is the need pricing decisions? Explain. (6)

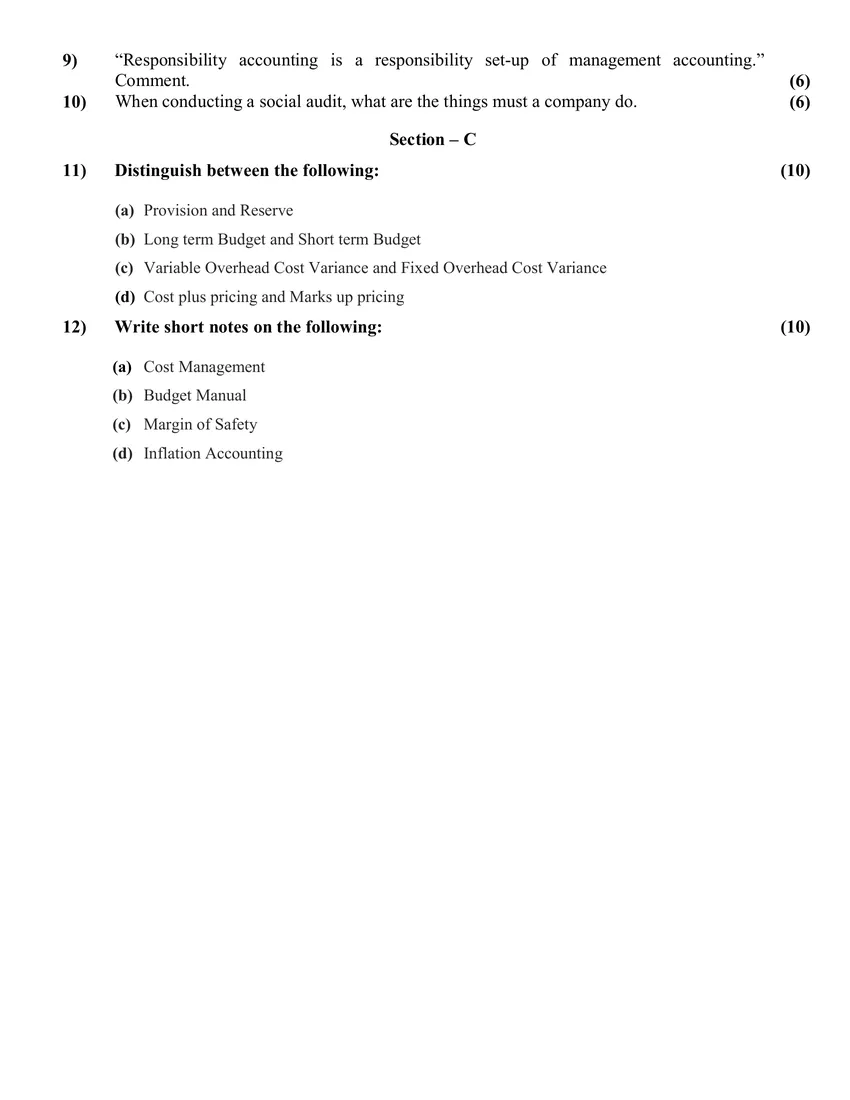

9) “Responsibility accounting is a responsibility set-up of management accounting.”

Comment. (6)

10) When conducting a social audit, what are the things must a company do. (6)

Section – C

11) Distinguish between the following:

(a) Provision and Reserve

(b) Long term Budget and Short term Budget

(c) Variable Overhead Cost Variance and Fixed Overhead Cost Variance

(d) Cost plus pricing and Marks up pricing

(10)

12) Write short notes on the following:

(a) Cost Management

(b) Budget Manual

(c) Margin of Safety

(d) Inflation Accounting

BCOE-142, BCOE 142, BCOE142

Reviews

There are no reviews yet.