- Your cart is empty

- Continue Shopping

BCOC-138 COST ACCOUNTING in English Solved Assignment 2023-2024

COURSE CODE : BCOC – 138

COURSE TITLE : COST ACCOUNTING

ASSIGNMENT CODE : BCOC – 138/TMA/2023-24

COVERAGE : ALL BLOCKS

| Title Name | BCOC-138 Solved Assignment 2023-2024 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | English |

| Semester | 2023-2024 Course: B.Com(G) CBCS |

| Session | Valid from 1st January 2024 to 31st December 2024 |

| Short Name | BCOC-138 |

| Assignment Code | BCOC – 138/TMA/2023-24 |

| Product | Assignment of BCOMG 2023-2024 (IGNOU) |

| Submission Date | 1. Those students who are appearing in June Term End Examination they have to submit latest by in 15th March. 2. Those students who are appearing in December exams. They should download the new assignment and submit the same latest by 15th October. |

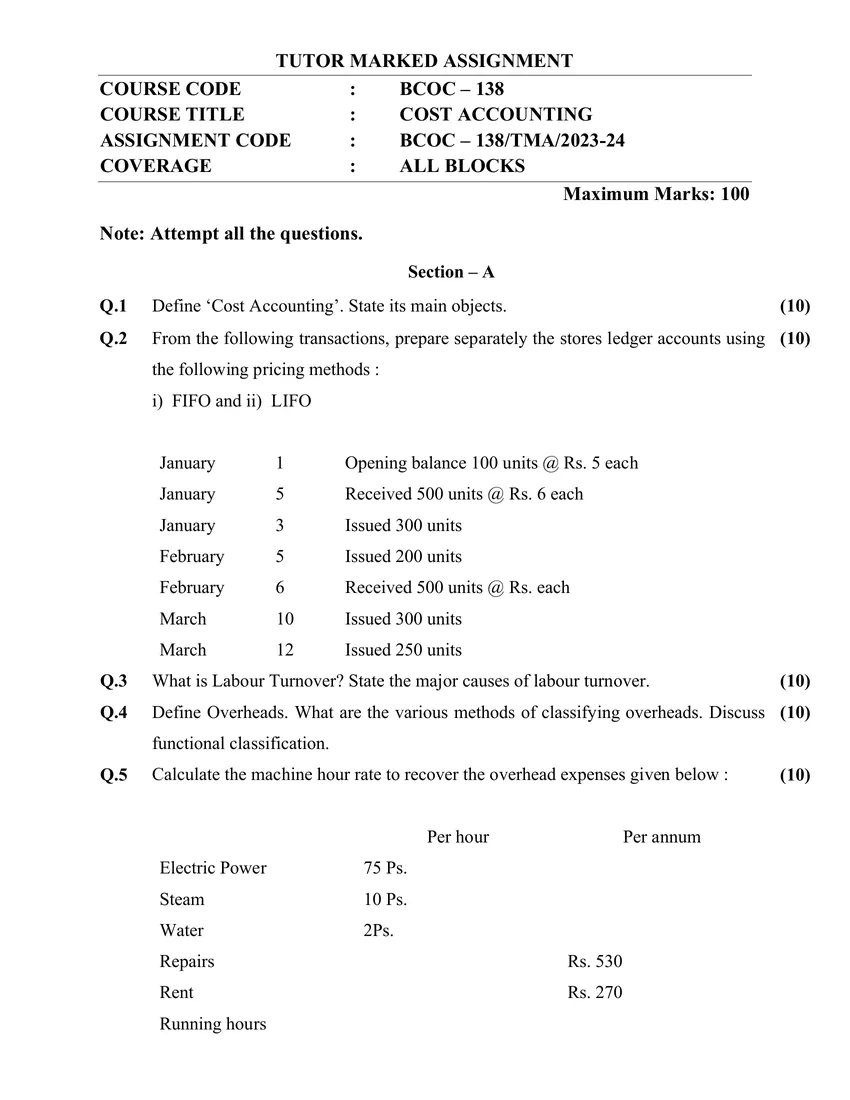

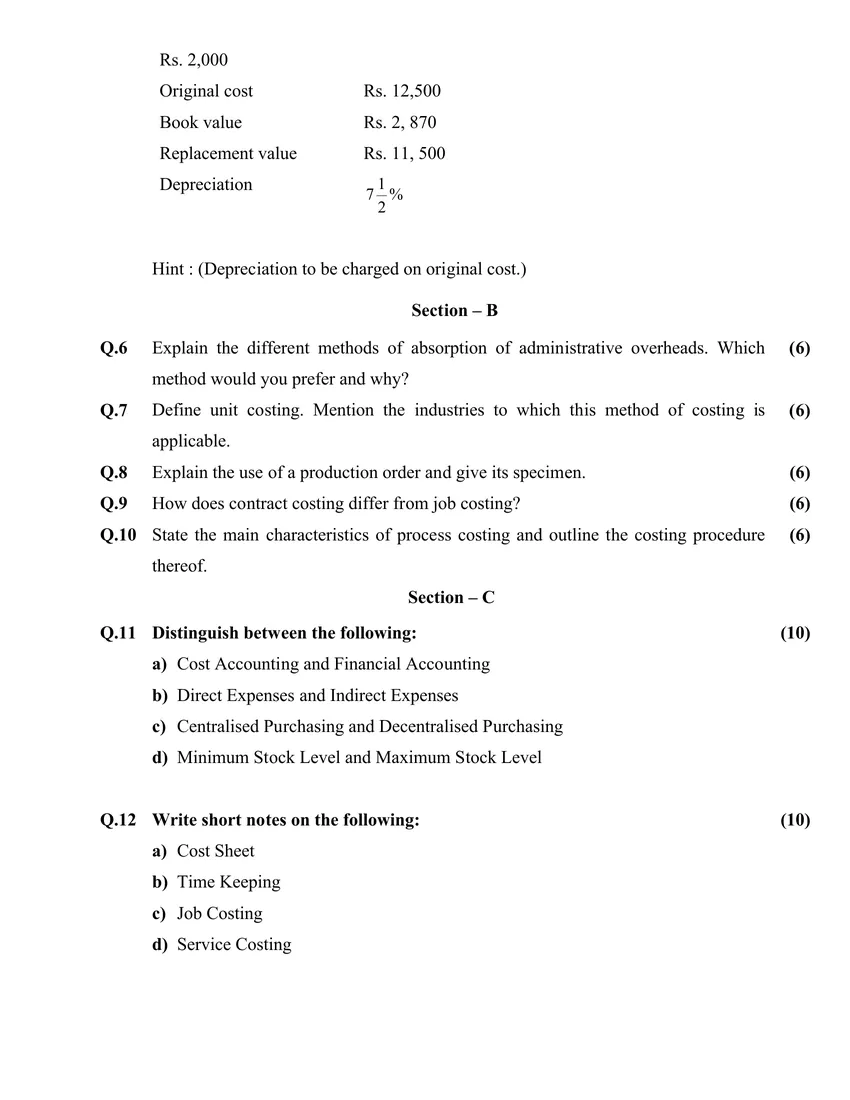

Note: Attempt all the questions.

Section – A

Q.1 Define ‘Cost Accounting’. State its main objects. (10)

Q.2 From the following transactions, prepare separately the stores ledger accounts using

the following pricing methods :

i) FIFO and ii) LIFO

January 1 Opening balance 100 units @ Rs. 5 each

January 5 Received 500 units @ Rs. 6 each

January 3 Issued 300 units

February 5 Issued 200 units

February 6 Received 500 units @ Rs. each

March 10 Issued 300 units

March 12 Issued 250 units

(10)

Q.3 What is Labour Turnover? State the major causes of labour turnover. (10)

Q.4 Define Overheads. What are the various methods of classifying overheads. Discuss

functional classification.

(10)

Q.5 Calculate the machine hour rate to recover the overhead expenses given below :

Per hour Per annum

Electric Power 75 Ps.

Steam 10 Ps.

Water 2Ps.

Repairs Rs. 530

Rent Rs. 270

Running hours

(10)

Rs. 2,000

Original cost Rs. 12,500

Book value Rs. 2, 870

Replacement value Rs. 11, 500

Depreciation %

2

1 7

Hint : (Depreciation to be charged on original cost.)

Section – B

Q.6 Explain the different methods of absorption of administrative overheads. Which

method would you prefer and why?

(6)

Q.7 Define unit costing. Mention the industries to which this method of costing is

applicable.

(6)

Q.8 Explain the use of a production order and give its specimen. (6)

Q.9 How does contract costing differ from job costing? (6)

Q.10 State the main characteristics of process costing and outline the costing procedure

thereof.

(6)

Section – C

Q.11 Distinguish between the following:

a) Cost Accounting and Financial Accounting

b) Direct Expenses and Indirect Expenses

c) Centralised Purchasing and Decentralised Purchasing

d) Minimum Stock Level and Maximum Stock Level

(10)

Q.12 Write short notes on the following:

a) Cost Sheet

b) Time Keeping

c) Job Costing

d) Service Costing

BCOC-138, BCOC 138 , BCOC138

Reviews

There are no reviews yet.