- Your cart is empty

- Continue Shopping

BCOC-137 CORPORATE ACCOUNTING Solved Assignment 2023-2024

COURSE CODE : BCOC – 137

COURSE TITLE : CORPORATE ACCOUNTING

ASSIGNMENT CODE : BCOC – 137/TMA/2023-24

COVERAGE : ALL BLOCKS

| Title Name | BCOC-137 Solved Assignment 2023-2024 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | English |

| Semester | 2023-2024 Course: B.Com(G) CBCS |

| Session | Valid from 1st January 2024 to 31st December 2024 |

| Short Name | BCOC-137 |

| Assignment Code | BCOC – 137/TMA/2023-24 |

| Product | Assignment of BCOMG 2023-2024 (IGNOU) |

| Submission Date | 1. Those students who are appearing in June Term End Examination they have to submit latest by in 15th March. 2. Those students who are appearing in December exams. They should download the new assignment and submit the same latest by 15th October. |

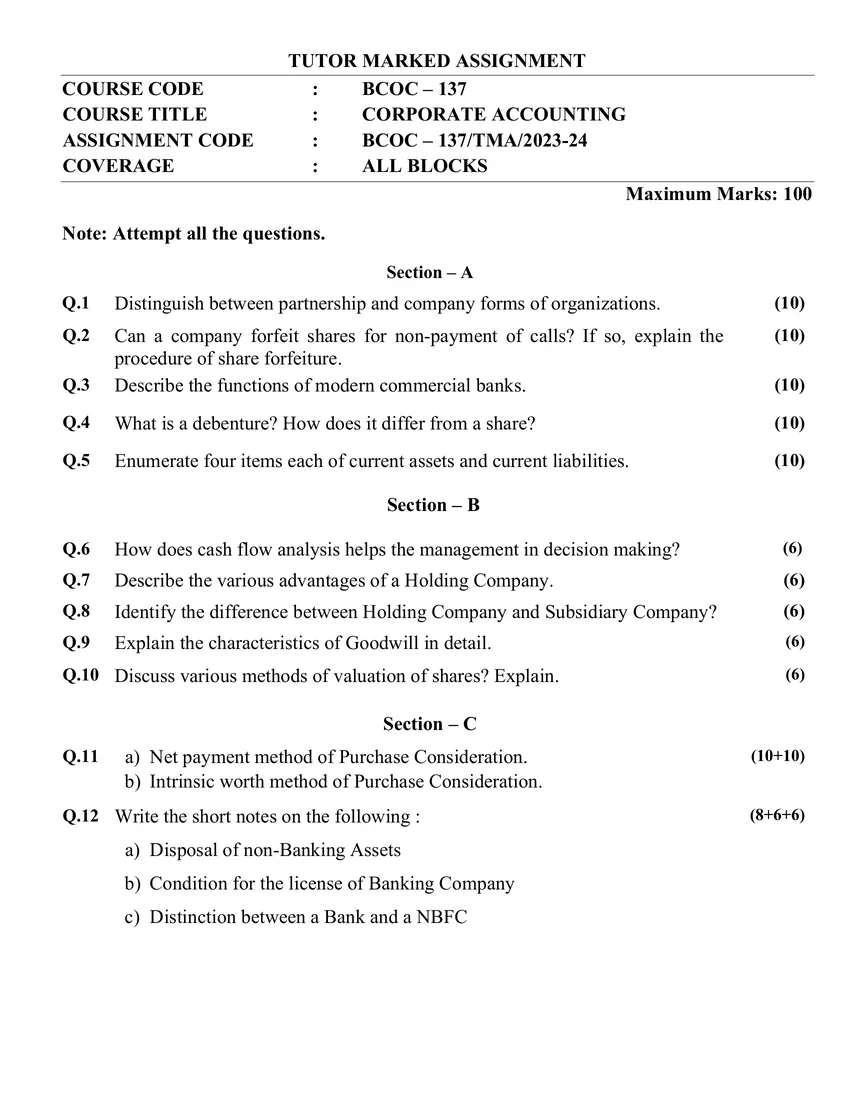

Note: Attempt all the questions.

Section – A

Q.1 Distinguish between partnership and company forms of organizations. (10)

Q.2 Can a company forfeit shares for non-payment of calls? If so, explain the

procedure of share forfeiture.

(10)

Q.3 Describe the functions of modern commercial banks. (10)

Q.4 What is a debenture? How does it differ from a share? (10)

Q.5 Enumerate four items each of current assets and current liabilities. (10)

Section – B

Q.6 How does cash flow analysis helps the management in decision making? (6)

Q.7 Describe the various advantages of a Holding Company. (6)

Q.8 Identify the difference between Holding Company and Subsidiary Company? (6)

Q.9 Explain the characteristics of Goodwill in detail. (6)

Q.10 Discuss various methods of valuation of shares? Explain. (6)

Section – C

Q.11 a) Net payment method of Purchase Consideration.

b) Intrinsic worth method of Purchase Consideration.

(10+10)

Q.12 Write the short notes on the following :

a) Disposal of non-Banking Assets

b) Condition for the license of Banking Company

c) Distinction between a Bank and a NBFC

BCOC 137, BCOC137, BCOC-137

Reviews

There are no reviews yet.