- Your cart is empty

- Continue Shopping

BCOC-136 INCOME TAX LAW & PRACTICE in English Solved Assignment 2024-2025

₹40.00

BCOC-136 INCOME TAX LAW & PRACTICE

Solved Assignment 2024-2025

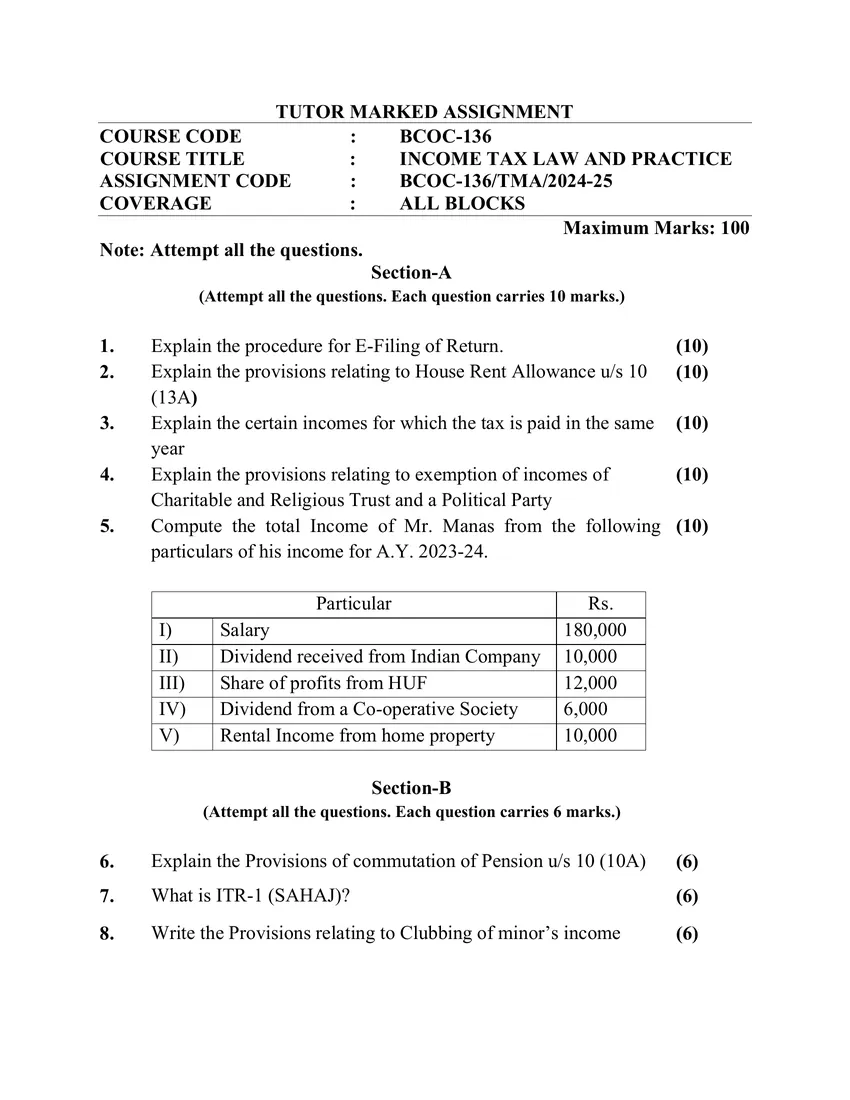

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOC-136

COURSE TITLE : INCOME TAX LAW AND PRACTICE

ASSIGNMENT CODE : BCOC-136/TMA/2024-25

COVERAGE : ALL BLOCKS

BCOC-136 INCOME TAX LAW & PRACTICE Solved Assignment 2024-2025

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOC-136

COURSE TITLE : INCOME TAX LAW AND PRACTICE

ASSIGNMENT CODE : BCOC-136/TMA/2024-25

COVERAGE : ALL BLOCKS

| Title Name | BCOC-136 Solved Assignment 2024-2025 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | ENGLISH |

| Semester | 2024-2025 Course: B.Com(G) CBCS |

| Session | Valid from 1st July 2024 to 30th June 2025 |

| Short Name | BCOC-136 |

| Assignment Code | BCOC-136/TMA/2024-25 |

| Product | Assignment of BCOMG 2024-2025 (IGNOU) |

| Submission Date | December Term End Examination: 15 October JuneTerm End Examination: 15 March |

Section-A

(Attempt all the questions. Each question carries 10 marks.)

1. Explain the procedure for E-Filing of Return. (10)

2. Explain the provisions relating to House Rent Allowance u/s 10

(13A)

(10)

3. Explain the certain incomes for which the tax is paid in the same

year

(10)

4. Explain the provisions relating to exemption of incomes of

Charitable and Religious Trust and a Political Party

(10)

5. Compute the total Income of Mr. Manas from the following

particulars of his income for A.Y. 2023-24.

Particular Rs.

I) Salary 180,000

II) Dividend received from Indian Company 10,000

III) Share of profits from HUF 12,000

IV) Dividend from a Co-operative Society 6,000

V) Rental Income from home property 10,000

(10)

Section-B

(Attempt all the questions. Each question carries 6 marks.)

6. Explain the Provisions of commutation of Pension u/s 10 (10A) (6)

7. What is ITR-1 (SAHAJ)? (6)

8. Write the Provisions relating to Clubbing of minor’s income (6)

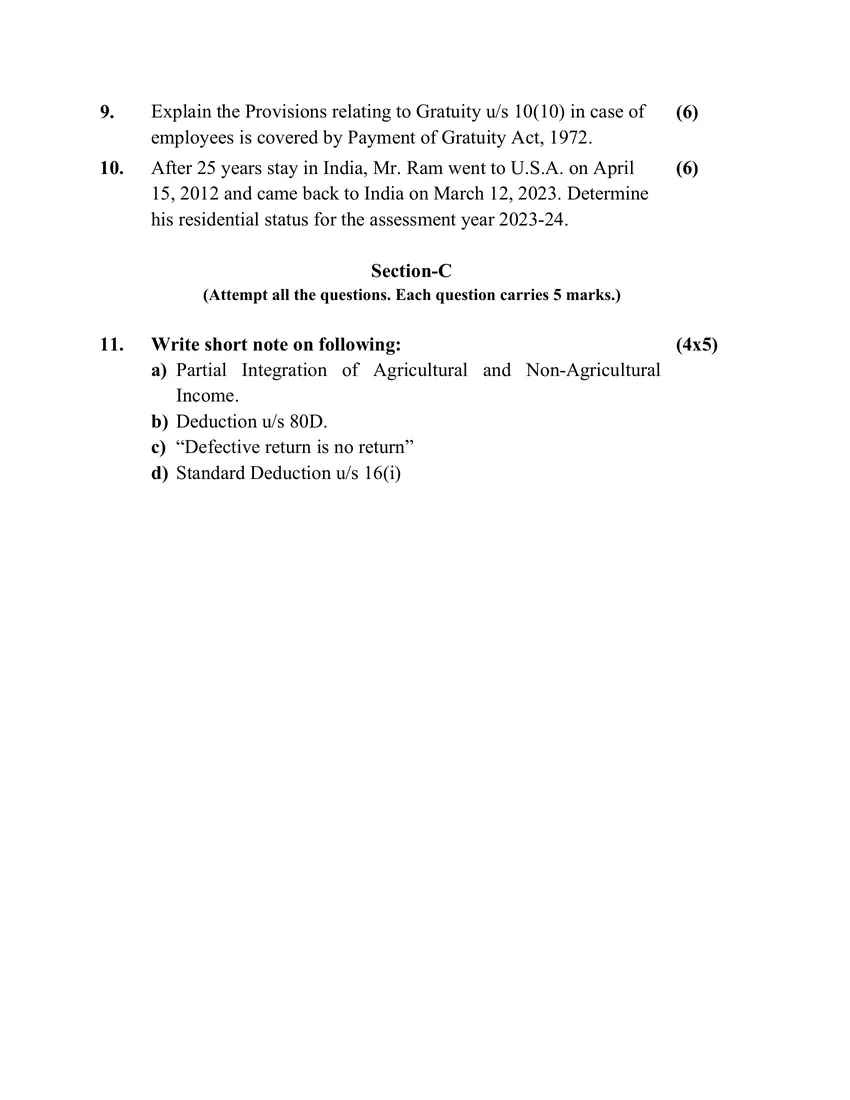

9. Explain the Provisions relating to Gratuity u/s 10(10) in case of

employees is covered by Payment of Gratuity Act, 1972.

(6)

10. After 25 years stay in India, Mr. Ram went to U.S.A. on April

15, 2012 and came back to India on March 12, 2023. Determine

his residential status for the assessment year 2023-24.

(6)

Section-C

(Attempt all the questions. Each question carries 5 marks.)

11. Write short note on following:

a) Partial Integration of Agricultural and Non-Agricultural

Income.

b) Deduction u/s 80D.

c) “Defective return is no return”

d) Standard Deduction u/s 16(i)

BCOC-136, BCOC 136, BCOC136

Reviews

There are no reviews yet.