- Your cart is empty

- Continue Shopping

BCOC-131 (B. Com G) Financial Accounting in English Solved Assignment 2024-2025

₹40.00Current price is: ₹40.00. Original price was: ₹100.00.

BCOC-131 (B. Com G) Financial Accounting

Solved Assignment 2024-2025

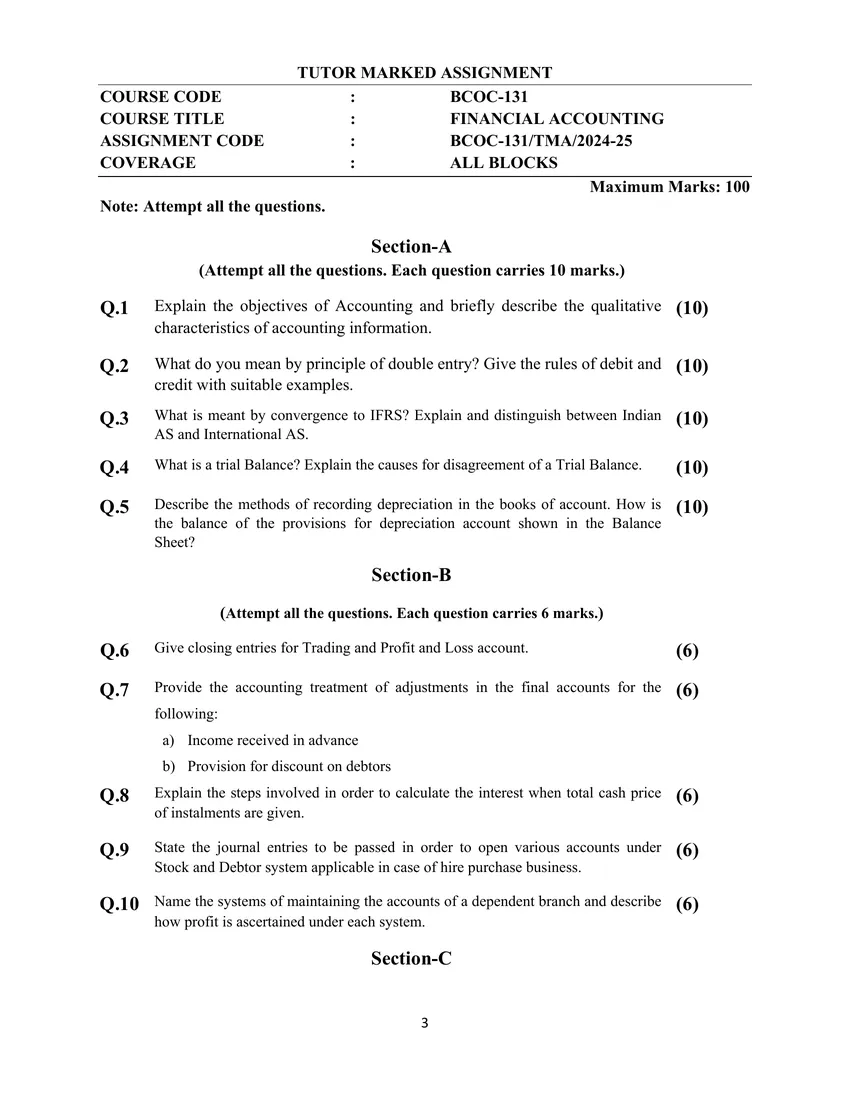

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOC-131

COURSE TITLE : FINANCIAL ACCOUNTING

ASSIGNMENT CODE : BCOC-131/TMA/2024-25

COVERAGE : ALL BLOCKS

Maximum Marks: 100

BCOC-131 (B. Com G) Financial Accounting Solved Assignment 2024-2025

TUTOR MARKED ASSIGNMENT

COURSE CODE : BCOC-131

COURSE TITLE : FINANCIAL ACCOUNTING

ASSIGNMENT CODE : BCOC-131/TMA/2024-25

COVERAGE : ALL BLOCKS

Maximum Marks: 100

| Title Name | BCOC-131 Solved Assignment 2024-2025 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BCOMG |

| Language | ENGLISH |

| Semester | 2024-2025 Course: B.Com(G) CBCS |

| Session | Valid from 1st July, 2024 to 30th June, 2025 |

| Short Name | BCOC-131 |

| Assignment Code | BCOC-131/TMA/2024-25 |

| Product | Assignment of BCOMG 2024-2025 (IGNOU) |

| Submission Date | December Term End Examination: 15 October June Term End Examination: 15 March |

Section-A

(Attempt all the questions. Each question carries 10 marks.)

Q.1 Explain the objectives of Accounting and briefly describe the qualitative

characteristics of accounting information.

(10)

Q.2 What do you mean by principle of double entry? Give the rules of debit and

credit with suitable examples.

(10)

Q.3 What is meant by convergence to IFRS? Explain and distinguish between Indian

AS and International AS.

(10)

Q.4 What is a trial Balance? Explain the causes for disagreement of a Trial Balance. (10)

Q.5 Describe the methods of recording depreciation in the books of account. How is

the balance of the provisions for depreciation account shown in the Balance

Sheet?

(10)

Section-B

(Attempt all the questions. Each question carries 6 marks.)

Q.6 Give closing entries for Trading and Profit and Loss account. (6)

Q.7 Provide the accounting treatment of adjustments in the final accounts for the

following:

a) Income received in advance

b) Provision for discount on debtors

(6)

Q.8 Explain the steps involved in order to calculate the interest when total cash price

of instalments are given.

(6)

Q.9 State the journal entries to be passed in order to open various accounts under

Stock and Debtor system applicable in case of hire purchase business.

(6)

Q.10 Name the systems of maintaining the accounts of a dependent branch and describe

how profit is ascertained under each system.

(6)

Section-C

4

(Attempt all the questions. Each question carries 10 marks.)

Q.11 Briefly explain various methods of recording the joint venture transactions without

maintaining separate set of books.

(10)

Q.12 Write short notes on the following:

a) Ledger creation

b) Creating invoices

BCOC-131, BCOC131, BCOC 131,

Reviews

There are no reviews yet.