- Your cart is empty

- Continue Shopping

MMPF-002 Capital Investment and Financing Decisions Solved Question Paper December 2022

₹20.00Current price is: ₹20.00. Original price was: ₹100.00.

MMPF-002 Capital Investment and Financing Decisions

Solved Question Paper December 2022

Capital Investment and Financing Decisions

Course Code: MMPF-002

MMPF-002 Capital Investment and Financing Decisions Solved Question Paper December 2022

Capital Investment and Financing Decisions

Course Code: MMPF-002

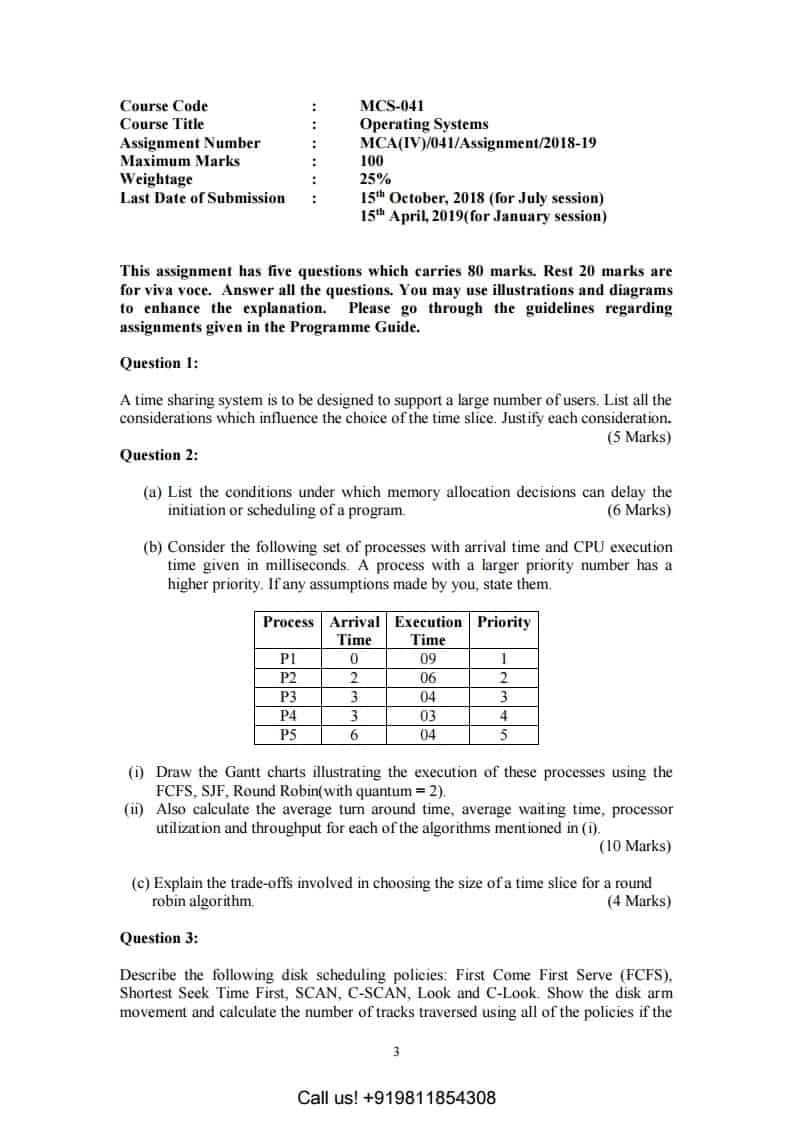

| Title Name | MMPF-002 Solved Question Paper December 2022 |

| University | IGNOU |

| Service Type | Solved Question Paper (Soft copy/PDF) |

| Course | MBA NEW |

| Language | English |

| Semester | |

| Year | December 2022 |

| Course Code | MMPF-002 |

| Product | Solved Question Paper (IGNOU) |

MASTER OF BUSINESS ADMINISTRATION

Term-End Examination

December, 2022

MMPF-002 : CAPITAL INVESTMENT AND

FINANCING DECISIONS

Time : 3 hours Maximum Marks : 100

Weightage 70%

Note : (i) Attempt any five questions.

(ii) All questions carry equal marks.

1. Discuss the nature of financial decisions and

explain the inter-relationship among these

decisions.

2. What do you understand by ‘Cost of Capital’ ?

How is the cost of long-term debt and equity

share capital computed ?

3. Discuss the distinguishing features of a project.

Explain the concept of project life cycle and

discuss the unique characteristics of each stage

of project life cycle.

4. What is Capital Budgeting ? How are the cash

flows for capital budgeting estimated ? Briefly

explain the discounted cash flow techniques used

for evaluating investment proposal.

5. What is ‘Project Control’ ? Explain the types of

control processes and specify the information

requirement for application of each of these

processes.

6. Explain the following :

(a) Certainty Equivalents

(b) Monte Carlo Simulation

7. Who are the Stakeholders of a company ? What

type of information is demanded by the different

stakeholders and in what aspects does this

information differ for different stakeholders ?

8. What is Corporate Restructuring ? Explain the

dimensions of restructuring. How is merger

assessed as a source of value addition ?

9. What are the major global sources of financing a

project ?

Reviews

There are no reviews yet.