- Your cart is empty

- Continue Shopping

BCOC-131 (BBA) Financial Accounting in English Solved Assignment 2024

₹40.00Current price is: ₹40.00. Original price was: ₹100.00.

BCOC-131 (BBA) Financial Accounting

Solved Assignment 2024

COURSE CODE : BCOC-131

COURSE TITLE : FINANCIAL ACCOUNTING

ASSIGNMENT CODE : BCOC-131/TMA/2024

COVERAGE : ALL BLOCKS

BCOC-131 (BBA) Financial Accounting Solved Assignment 2024

COURSE CODE : BCOC-131

COURSE TITLE : FINANCIAL ACCOUNTING

ASSIGNMENT CODE : BCOC-131/TMA/2024

COVERAGE : ALL BLOCKS

| Title Name | BCOC-131 Solved Assignment 2024 |

| University | IGNOU |

| Service Type | Solved Assignment (Soft copy/PDF) |

| Course | BBA |

| Language | ENGLISH |

| Semester | 2024 Course: BBA |

| Session | Valid from 1st January, 2024 to 30th December, 2024 |

| Short Name | BCOC-131 |

| Assignment Code | BCOC-131/TMA/2024 |

| Product | Assignment of BBA 2024 (IGNOU) |

| Submission Date | Those students who are appearing in December Term End Examination they have to submit latest by in 15 October. Those students who are appearing in June exams. They should download the new assignment and submit the same latest by 15 March |

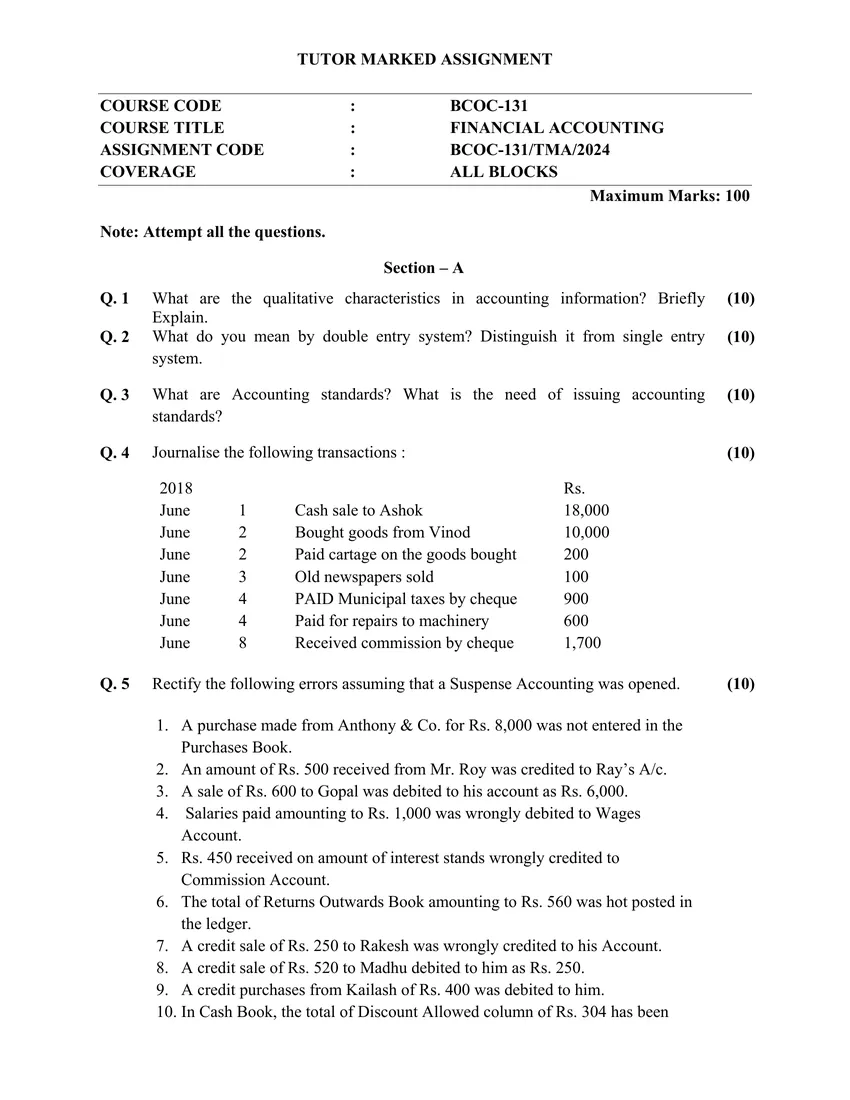

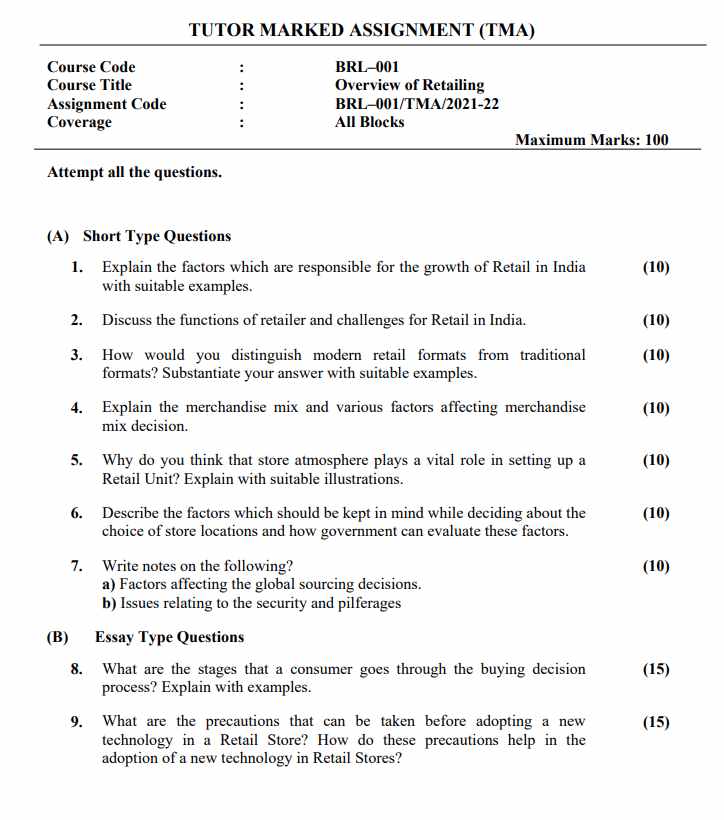

Q. 1 What are the qualitative characteristics in accounting information? Briefly Explain.

(10)

Q. 2 What do you mean by double entry system? Distinguish it from single entry system.

(10)

Q. 3 What are Accounting standards? What is the need of issuing accounting standards?

(10)

Q. 4 Journalise the following transactions :

2018 Rs.

June 1 Cash sale to Ashok 18,000

June 2 Bought goods from Vinod 10,000

June 2 Paid cartage on the goods bought 200

June 3 Old newspapers sold 100

June 4 PAID Municipal taxes by cheque 900

June 4 Paid for repairs to machinery 600

June 8 Received commission by cheque 1,700

(10)

Q. 5 Rectify the following errors assuming that a Suspense Accounting was opened.

1. A purchase made from Anthony & Co. for Rs. 8,000 was not entered in the Purchases Book.

2. An amount of Rs. 500 received from Mr. Roy was credited to Ray’s A/c.

3. A sale of Rs. 600 to Gopal was debited to his account as Rs. 6,000.

4. Salaries paid amounting to Rs. 1,000 was wrongly debited to Wages Account.

5. Rs. 450 received on amount of interest stands wrongly credited to Commission Account.

6. The total of Returns Outwards Book amounting to Rs. 560 was hot posted in the ledger.

7. A credit sale of Rs. 250 to Rakesh was wrongly credited to his Account.

8. A credit sale of Rs. 520 to Madhu debited to him as Rs. 250.

9. A credit purchases from Kailash of Rs. 400 was debited to him.

10. In Cash Book, the total of Discount Allowed column of Rs. 304 has been (10)

carried forward as Rs. 403.

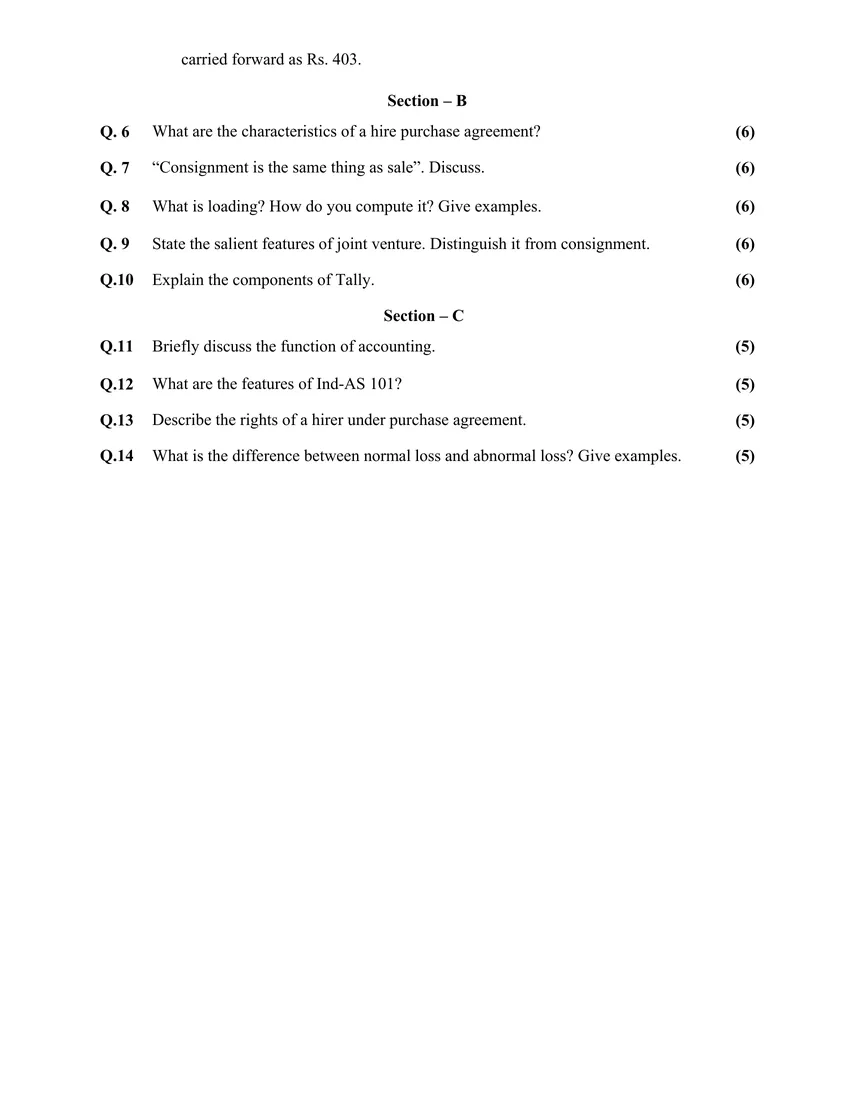

Section – B

Q. 6 What are the characteristics of a hire purchase agreement? (6)

Q. 7 “Consignment is the same thing as sale”. Discuss. (6)

Q. 8 What is loading? How do you compute it? Give examples. (6)

Q. 9 State the salient features of joint venture. Distinguish it from consignment. (6)

Q.10 Explain the components of Tally. (6)

Section – C

Q.11 Briefly discuss the function of accounting. (5)

Q.12 What are the features of Ind-AS 101? (5)

Q.13 Describe the rights of a hirer under purchase agreement. (5)

Q.14 What is the difference between normal loss and abnormal loss? Give examples.

BCOC-131, BCOC 131, BCOC131

Reviews

There are no reviews yet.